With every use of the PLEX card, your customers can earn rewards with your brand - expand loyalty and rewards programs with financial solutions for every industry and customer segment.

Transaction processing

The processing of all People Express (PLEX) debit and credit cards via Commonwealth Pay is fixed at 1% of transaction, without any additional payments – allowing you to do micro payments and providing the cheapest processing costs of any card scheme.

Generate new revenue streams

Issue physical or virtual PLEX cards and collect interchange revenue on every card tap, swipe, or purchase. Your enterprise gains a percentage from every transaction. Promotional cards become a source of revenue, not just a cost.

Own the customer experience

Integrate a digital wallet experience within your existing website or app, with no other brand to share the real estate. Control, design, and personalize rewards with earnings from interchange revenue, user fees or interest-bearing accounts.

Quick processing & settlement of digital payouts

Skip the physical processes by offering digital disbursement options, including instant, prepaid virtual cards with automated delivery through an app, e-mail, or text - integrated seamlessly into your existing products and services.

This allows to make disbursable funds available 24/7 without being tied to traditional bank hours.

Increase customer loyalty

Ensure your customers choose your business by offering more rewards than the competition.

As customers consider where they’ll spend next, your brand is top-of-mind with a white-label PLEX card that has brand-specific and merchant-funded rewards.

Improve cash flow operations via real-time funding

The traditional way of issuing cards requires funding of cards up-front, tying up funds. With real-time funding, a parent account funds each card the moment it is actually used by being swiped or tapped. This enables holding onto cash longer and thus improving cash flow.

Plus, when there is breakage and the full card amount is not spent, your company, as the card issuer, keeps the funds.

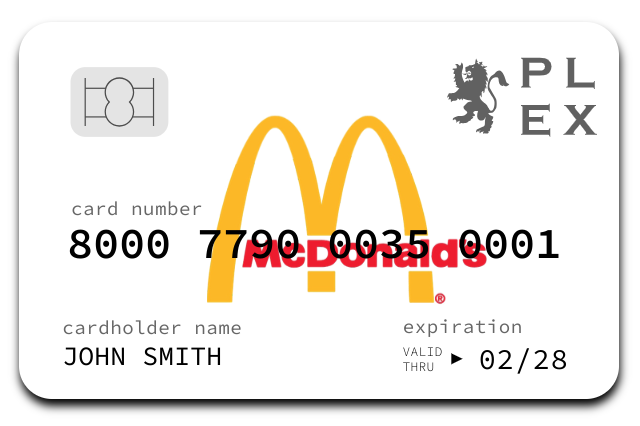

PLEX Branded Cards

Offer debit, gift, or prepaid cards in your own brand to maximize loyalty and rewards. Your brand can apply cashback, discounts, rewards, or refunds to the a PLEX card balance.

Through the Commonwealth’s Banking Gateway your enterprise can launch PLEX Branded Cards to improve cash flow, earn revenue, disburse funds, increase customer loyalty and tailor experiences.

You don’t have to worry about anything, we do the fulfillment and comply with all regulations.

How it works

Physical cards

Send customers physical cards in your brand to stay top-of-mind in their physical wallet.

Virtual cards

Deliver cards virtually for an instantly rewarding customer experience through your app, website, or other digital communication.

Rewards & cashback

Offer a percentage back from each purchase in cash, funded from interchange revenue. Or, reward customers for certain actions or merchant specific spending.

Open or closed-loop

Design your card program to be closed-loop (your store or platform) or open-loop to gain visibility into customer spend outside of your business.

Engage more customers

Engage customers who may not qualify for credit card options, enabling them to earn loyalty points and rewards with a PLEX card - without credit checks to open an account.

A PLEX card is any electronic payment card that is part of the People Express Card Scheme (PLEX) and uses the PLEX System for processing transaction communications and is branded with the PLEX logo. The card scheme was launched in March 2022 by the British Technology Bank that is now the Division of Technology of the Bank of Commonwealth, which operates the card scheme and its underlying payment system (PLEX System) that allows members of the scheme to authorise, clear and settle transactions on any PLEX card that is part of the scheme. Features are subject to change. Some features, applications, and services may not be available in all regions or all languages. Each service has its own terms and all trademark belongs to The Commonwealth Crown.